Creating a strategy #

Have you made your own strategy? Gekko Plus is hosting an official Strategy contest: submit your strategy and have a change to win 0.1 BTC! Read more details on Gekko Plus.

Strategies are the core of Gekko's trading bot. They look at the market and decide what to do based on technical analysis indicators. A single strategy is limited to a single market on a single exchange.

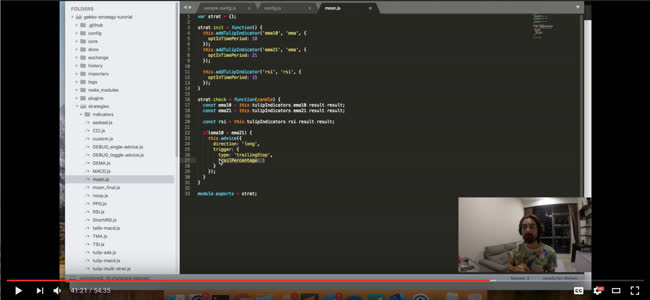

Gekko currently comes with a couple of strategies out of the box. Besides those you can also write your own strategy in javascript. If you want to understand how to create your own strategy you can watch this video or read the tech docs on this page.

A strategy is a module with a few functions that get market data in the form of candles (OHLC, volume, and the average weighted price) and output trading advice.

Strategy boilerplate #

// Let's create our own strategy

var strat = {};

// Prepare everything our strat needs

strat.init = function() {

// your code!

}

// What happens on every new candle?

strat.update = function(candle) {

// your code!

}

// For debugging purposes.

strat.log = function() {

// your code!

}

// Based on the newly calculated

// information, check if we should

// update or not.

strat.check = function(candle) {

// your code!

}

// Optional for executing code

// after completion of a backtest.

// This block will not execute in

// live use as a live gekko is

// never ending.

strat.end = function() {

// your code!

}

module.exports = strat;

Strategy lifecycle methods #

The above boilerplate contains four functions. These functions are executed by Gekko like so:

- When Gekko starts: run init.

- On each new candle:

init function #

Executed when the trading strategy starts. Your strategy can initialize state and register indicators.

update function #

This function executes on every new candle. You can access the latest candle as the first (and only) parameter (it's also stored in this.candle).

log function #

The log function is executed on every new candle when the debug flag is on (always off when running in the UI, as configured in the config for CLI gekkos). Logging is used to log certain state from the strategy and can be used to debug your strategy to get more insights in why it took certain decisions.

check function #

Most strategies need to warmup before the trading strategy can be started. For example the strategy may be calculating a moving average for the first 3 candles, as such it must have at least 3 candles to output a number the strategy logic relies on. The check function is executed after the warmup period is over. The default required history is 0. You can set it like so in your init function:

this.requiredHistory = 5; // require 5 candles before giving advice

If you find out in the check function that you want to give new advice to the trader you can use the advice function:

this.advice({

direction: 'long', // or short

trigger: { // ignored when direction is not "long"

type: 'trailingStop',

trailPercentage: 5

// or:

// trailValue: 100

}

});

The trigger is optional, if the direction is long and the trigger is specified as a trailingStop this will request the trader to create a trail stop trigger.

candle variable #

The following list of candle variables will be available when writing strategies, they are part of the candle object which is given to your update and check functions (it's also accessable through this.candle).

- candle.close: the closing price of the candle

- candle.high: the highest price of the candle

- candle.low: the lowest price of the candle

- candle.volume: the trading volume of that candle

- candle.trades: number of trades in that candle

Things to keep in mind #

- You can activate your own strategy by setting

config.tradingAdvisor.strategytocustom(or whatever you named your file inside thegekko/strategies) in the loaded config. - Gekko will execute the

updatefunction for every new candle. A candle is the size in minutes configured atconfig.tradingAdvisor.candleSizein the loaded config. - It is advised to set history

config.tradingAdvisor.historySizethe same as the requiredHistory as Gekko will use this property to create an initial batch of candles. - Never rely on anything based on system time because each method can run on live markets as well as during backtesting. You can look at the

candle.startproperty which is amomentobject of the time the candles started.

Strategy tools #

To help you Gekko has a number of strategy tools.

Indicators #

Gekko supports a few indicators natively, in addition to the integration of indicators from the library TA-lib.

Example usage #

If you want to use an indicator you can add it in the init function and Gekko will handle the updating for you on every candle (before the update and before the check call):

// add a native indicator

this.addIndicator('name', 'type', parameters);

or

// add a TA-lib indicator

this.addTalibIndicator('name', 'type', parameters);

or

// add a Tulip indicator

this.addTulipIndicator('name', 'type', parameters);

The first parameter is the name, the second is the indicator type you want and the third is an object with all indicator parameters. If you want an MACD indicator you can do it like so:

In your init function:

// add a native indicator

var parameters = {short: 10, long: 20, signal: 9};

this.addIndicator('mynativemacd', 'MACD', parameters);

// add a TA-lib indicator

var parameters = {optInFastPeriod: 10, optInSlowPeriod: 21, optInSignalPeriod: 9};

this.addTalibIndicator('mytalibmacd', 'macd', parameters);

// add a Tulip indicator

var parameters = {optInFastPeriod: 10, optInSlowPeriod: 21, optInSignalPeriod: 9};

this.addTulipIndicator('mytulipmacd', 'macd', parameters);

In your check or update function:

var result = this.indicators.mytalibmacd.result;

See the TA-lib indicators document for a list of all supported TA-lib indicators and their required parameters.

See the Tulip indicators document for a list of all supported Tulip indicators and their required parameters.

Strategy parameters #

Adjust strategy execution by creating custom strategy parameters. This way the same strategy can execute strategies concurrently using different parameters for different markets. For example the MACD strategy has parameters concerning the underlying MACD indicator (such as values for the LONG and SHORT EMAs). Create custom configuration settings in the config/strategies directory:

// custom settings:

config.custom = {

my_custom_setting: 10,

};

Retrieve them in your strategy like this:

// anywhere in your code:

log.debug(this.settings.my_custom_setting); // Logs 10

Note that the name of your configuration must be the same as the name of the strategy

External libraries #

Gekko uses a few general purpose libraries internally. The API from those libraries are available to you as well. Most notable libraries are lodash (similar as underscore) and async.

You can load them like so:

// before any other code

var _ = require('lodash');

var async = require('async');

Logging #

Gekko has a small logger you can use (preferably in your log function):

// before any other code

var log = require('../core/log.js');

// in your log function

log.debug('hello world');

Take a look at the existing methods, if you have questions feel free to create an issue. If you created your own awesome strategies and want to share it with the world feel free to contribute it to gekko.